The Funding Files

The Funding Files

Podcast Description

Kia ora and welcome everyone to THE FUNDING FILES, where we explore the highs, lows and cashflows of funding a business in Aotearoa New Zealand.

Podcast Insights

Content Themes

The podcast covers a range of topics related to business funding, including crowdfunding, investment strategies, and personal funding journeys. For instance, episodes include discussions on the founding story of Morningcider, the dynamics of joint ventures, and Anna Guenther's innovative approach to launching the PledgeMe crowdfunding platform.

Kia ora and welcome everyone to THE FUNDING FILES, where we explore the highs, lows and cashflows of funding a business in Aotearoa New Zealand.

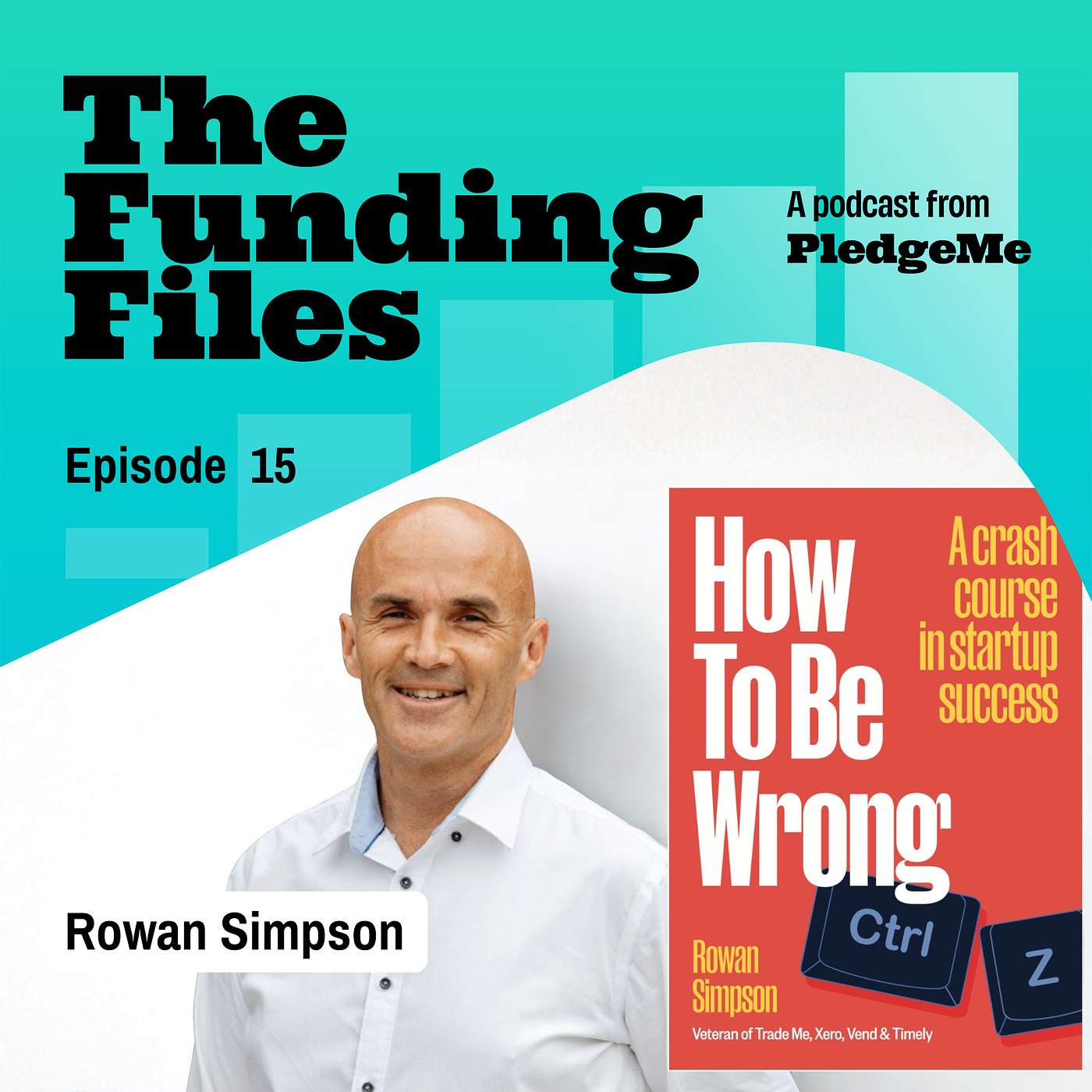

In this episode of the Funding Files, we interview Rowan Simpson, a key figure in Aotearoa New Zealand's tech scene. He recounts his founding and funding journey, starting with Flat Hunt, which was acquihired by Trade Me, leading to his early involvement in Trade Me's growth and eventual $750 million exit. He later became an early investor and employee at Xero, and invested in Vend and Timely, contributing both capital and expertise. He recently wrote a book called 'How to Be Wrong' that shares some really interesting stories from behind the scenes in those companies.

In the pod, Rowan shares his experience joining Trade Me, and then leaving for his OE thinking that it hadn't worked. He was called home when the platform started taking off, and he had to make a slightly awkward call to the bank when the exit occured to ensure his account wasn't frozen.

We hear about Vend's funding rounds, including successful venture capital raises and a near-fatal funding collapse that required tough decisions and restructuring. He reflects on the discipline and focus that funding constraints can impose, and the emotional toll on teams, founders and investors. He also highlights the importance of selecting investors who add value beyond money, advocating for focusing on 'who' invests rather than just valuation or amount raised.

He also talks about funding instruments, contrasting convertible notes and equity rounds, cautioning founders about misconceptions. Rowan possibly contraversially tells founders to avoid focusing on exit plans, noting that venture investments typically take over a decade to mature, and stresses investing in resilient teams.

He recounts his investment in Xero's IPO, acknowledging the long and volatile journey before its success.

In this episode, Rowan provides invaluable insights into startup funding, and stories about the highs, the lows, and the perseverance required to build successful companies in Aotearoa, New Zealand.

—

Kia ora and welcome everyone to THE FUNDING FILES, where we explore the highs, lows and cashflows of funding a business in Aotearoa New Zealand.

Huge thanks to the founders for sharing their stories, to our board for inspiring us to make this pod, and to Rory Harnden for making our design and intro string.

Disclaimer

This podcast’s information is provided for general reference and was obtained from publicly accessible sources. The Podcast Collaborative neither produces nor verifies the content, accuracy, or suitability of this podcast. Views and opinions belong solely to the podcast creators and guests.

For a complete disclaimer, please see our Full Disclaimer on the archive page. The Podcast Collaborative bears no responsibility for the podcast’s themes, language, or overall content. Listener discretion is advised. Read our Terms of Use and Privacy Policy for more details.